Friendly, practical,

business-savvy developers

Yes, we really do exist.

SEE WHAT WE DO

Database programmers.

Web developers. Trusted partners.

Our clients depend on us to dive deep into their business issues, re-imagine processes, elucidate strategies, and be totally transparent about costs. They count on us to build reliable systems using the industry’s most bulletproof software. And they fully appreciate that we’re practical innovators who only recommend new technologies when we’re certain they can provide long-term value.

A human approach to application development.

Let go of that programmer stereotype: introverted, oblivious to budget, and hell-bent on using all the latest gadgets. At J Street, we’re fully plugged in to the human dynamics behind creating successful partnerships and phenomenal solutions. You won’t find anyone that’s better at listening carefully, anticipating issues, and avoiding pitfalls.

HOW TO CHOOSE A DEVELOPMENT TEAM

From cruise ships to clogs, we’re into it.

Our clients represent an astounding variety of industries. Some have household names; some you’ve never heard of. Some are local; others multinational. There are for-profit businesses, and not-for-profits, too. But they all have one thing in common: Every day, J Street’s solutions help them do what they do even better.

WHAT CLIENTS SAY ABOUT J STREET

Engaged. Insightful. Enduring. That’s J Street.

We may be some of the most seasoned, business-savvy application developers you’ll ever meet. We also happen to be some of the warmest, most candid, and clear-thinking folks on the planet. Our clients love that about us. We bet you will, too.

GET A FREE CONSULTATIONHeartland Bank Case Study

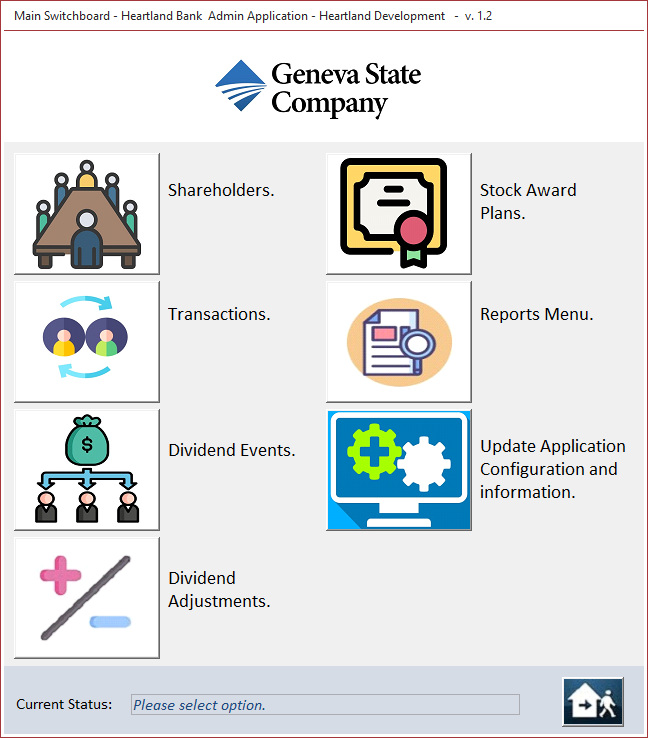

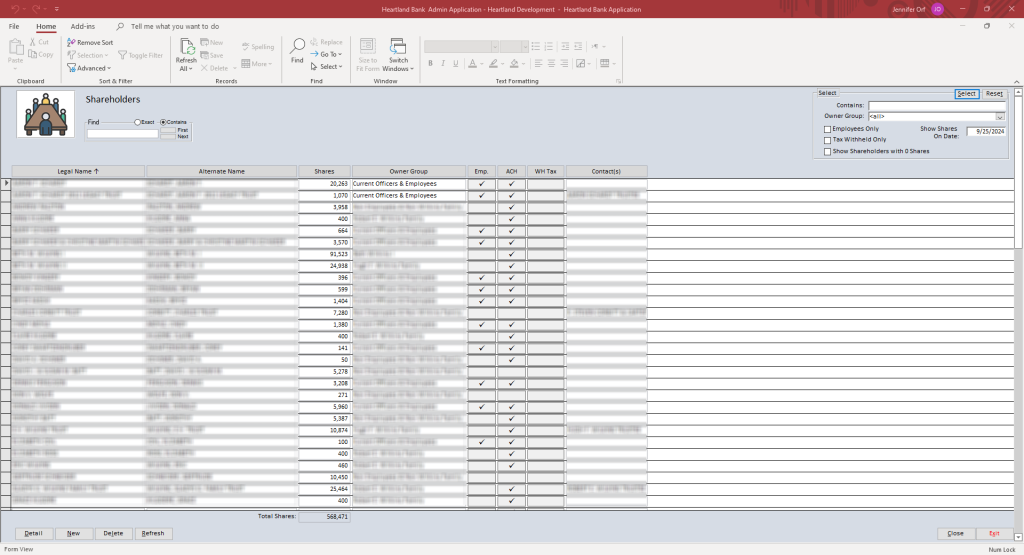

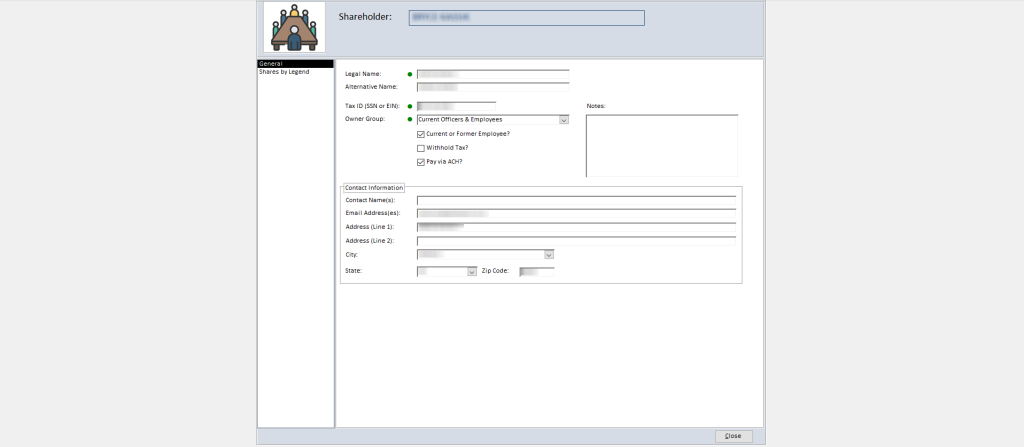

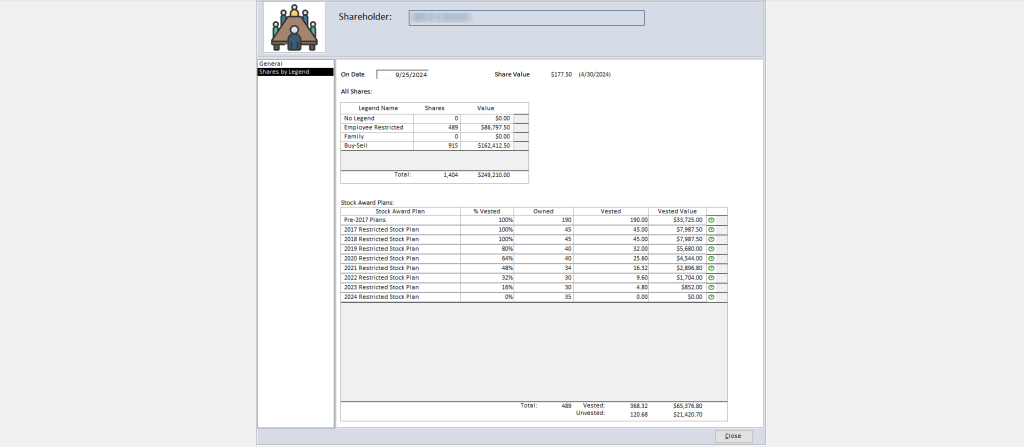

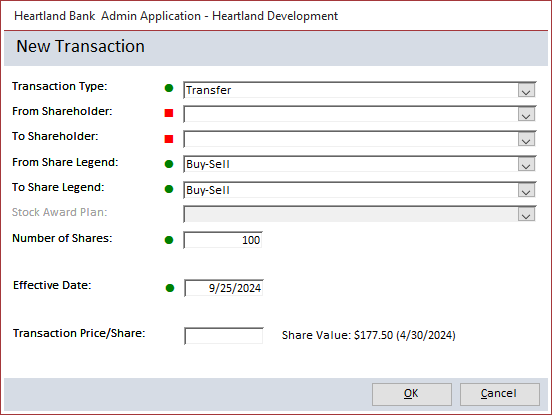

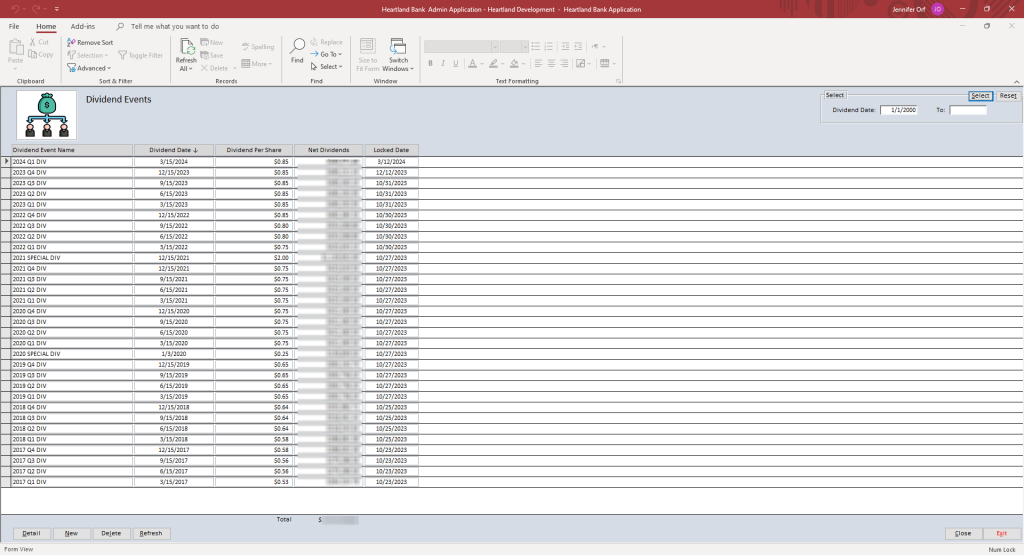

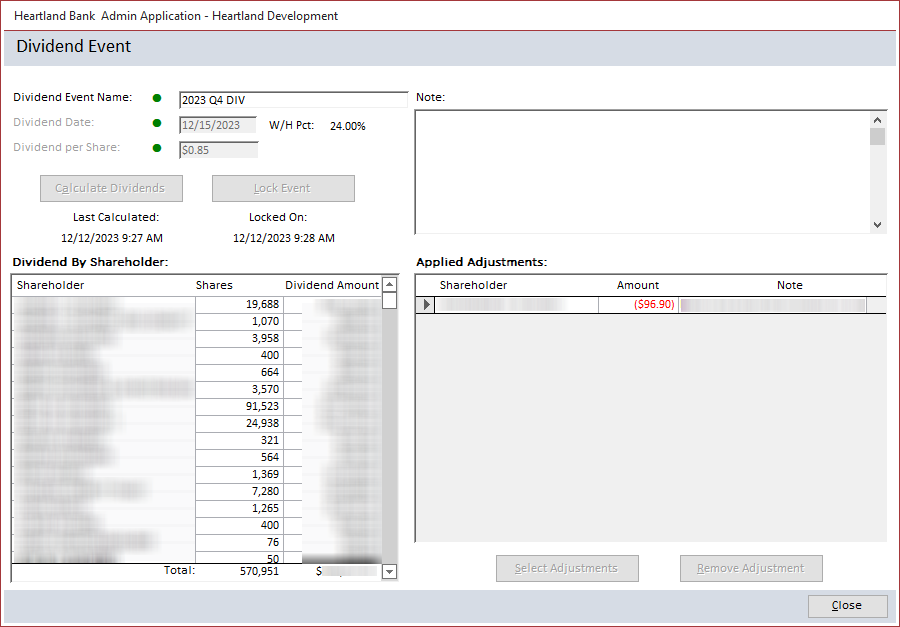

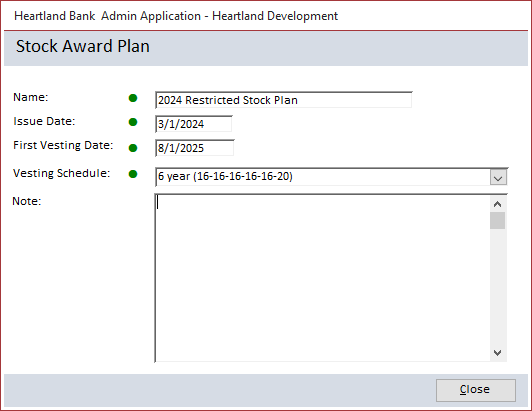

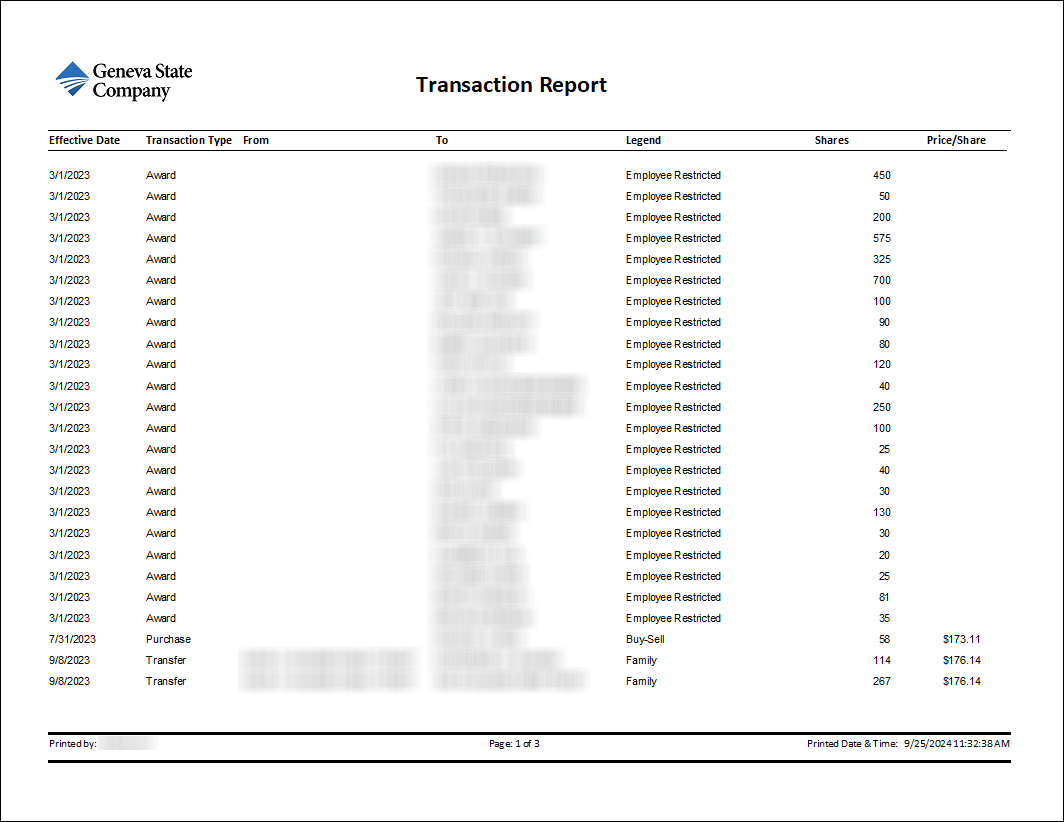

Heartland Bank, a family-owned bank network in Nebraska, hired J Street to develop an Access application to manage shareholder transactions, dividends, and stock plans more efficiently. The project aimed to replace difficult and time-consuming spreadsheet-based processes with a more reliable, automated, and secure system. These improvements contributed to a more efficient and scalable operation for Heartland Bank.

Need:

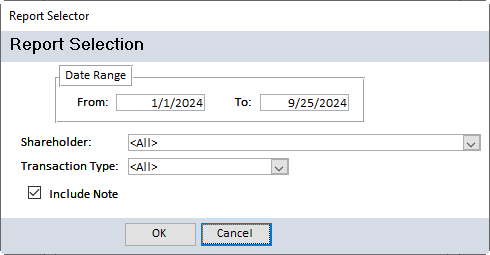

Design a new Stock & Shareholder Transaction Recording System that produces clear, accessible reports to keep track of shareholders, and support transactions that include flexible features to accommodate potential future needs like vesting schedules.

Solution:

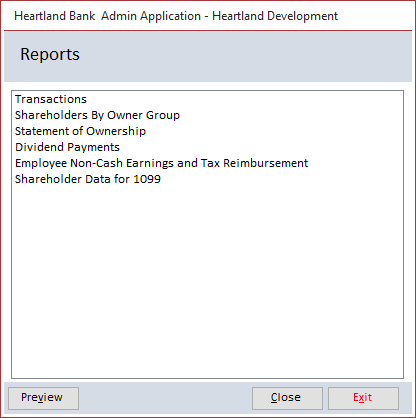

An Access/SQL desktop application that streamlines data management while enhancing reporting and compliance. Access was chosen because of its rapid development (reducing timeline and cost), Heartland’s familiarity with desktop applications, and the small number of users working exclusively in the office on Windows PCs.

Technologies used:

Access & SQL Server